Home > Compliance > AML/CFT

External AML/CFT Expert Examination Accredited by ENAC

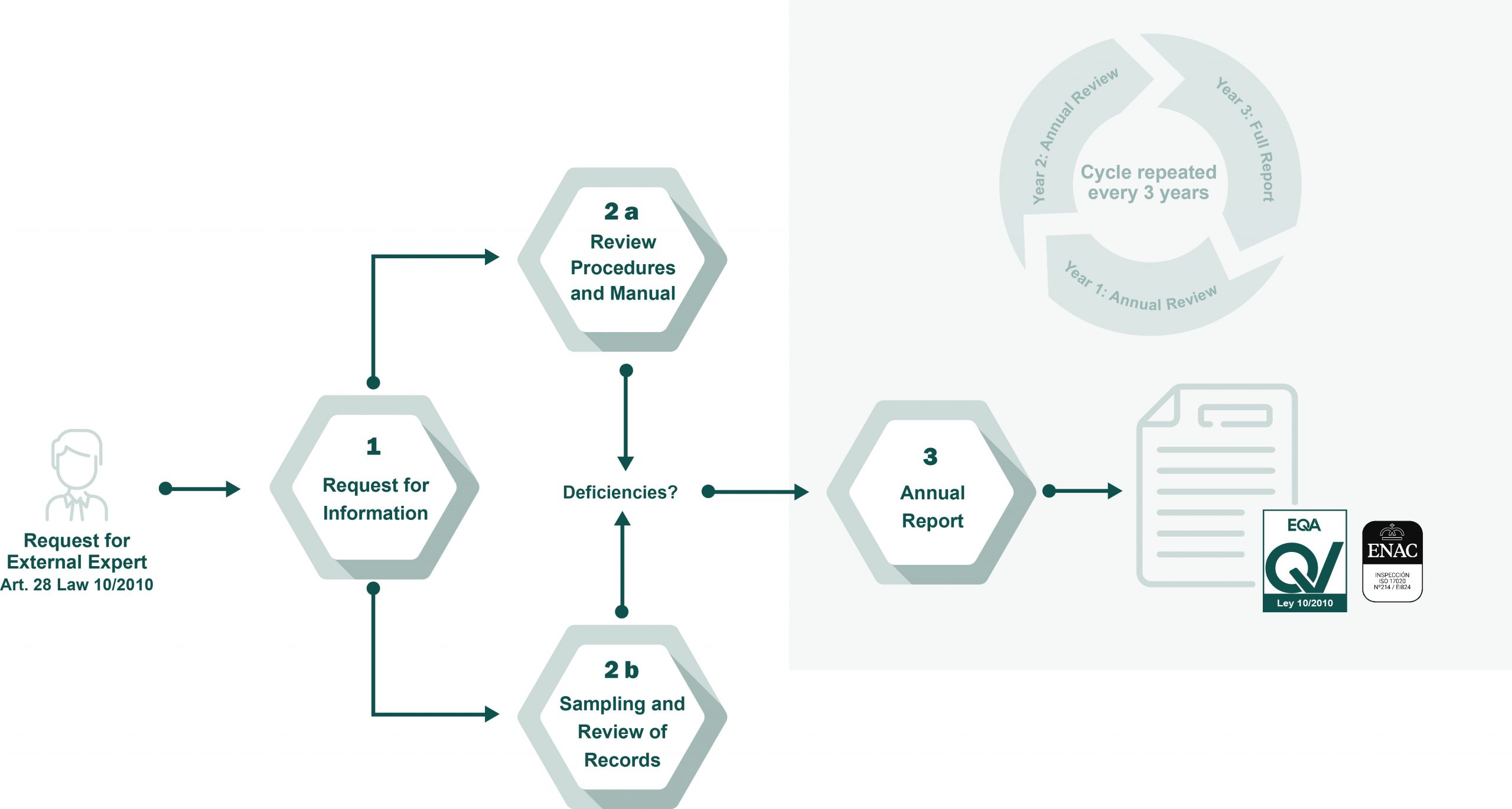

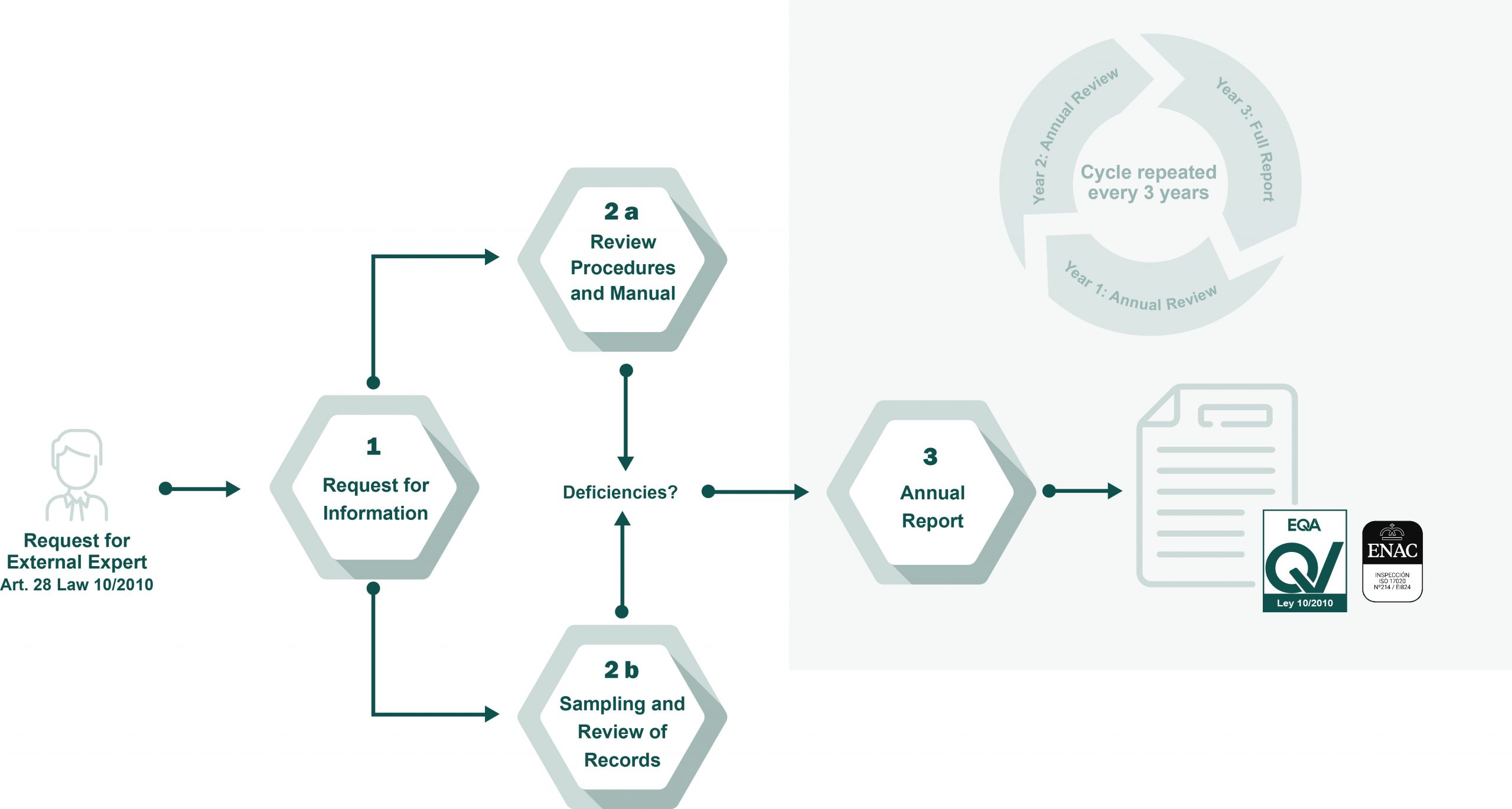

Law 10/2010 and Royal Decree 304/2014 establish the requirements that regulated entities must comply with in the prevention of money laundering and terrorist financing. These include the obligation to examine the internal control measures established in AML/CFT and to record them in writing in a report issued by an Independent External Expert in accordance with the provisions of Order EHA 2444/2007, of 31 July, which assesses the operational effectiveness and, where appropriate, allows the organisation to propose rectifications or improvements to the system.

In the two years following the issuance of the report, this may be replaced by a follow-up report issued by the same External Expert, referring exclusively to the adequacy of the measures adopted by the obliged entity to resolve the deficiencies identified.

These reports must be available to the Commission for the Prevention of Money Laundering and Monetary Offences or its support bodies for five years from the date of issue.

To date, there were no solid criteria to help obligated parties select an External Expert to carry out the review and analysis required by the legislation. However, in 2020 the National Accreditation Body (ENAC), the body designated by the Government to establish and maintain the accreditation system at national level, in accordance with international standards and the policies and recommendations established by the European Union, published the Specific Accreditation Criteria for Examination Bodies for the Prevention of Money Laundering and Terrorist Financing (CEA ENAC 25) in accordance with the methodology required by the international standard of good practice UNE-EN ISO /EIC 17020:2012.

These criteria facilitate the due diligence of the organisations for the selection of the External Expert to the extent that those acting under Accreditation criteria must comply with a series of additional procedures that ensure the quality of their work, in addition to always acting under the regular supervision of ENAC itself.

Since March 2021, EQA has been accredited by ENAC to carry out the annual examination by External Expert, being one of the pioneers in providing the service under regulated accreditation criteria, with a qualified team registered with SEPBLAC.

Prevention of Money Laundering and Terrorist Financing Diagram

Frequently Asked Questions

Am I obliged to have my anti-money laundering procedures reviewed by an independent external expert?

Article 2 of Law 10/2010 lists all the obliged parties to whom it applies. Article 28 establishes the obligation that the internal control measures and bodies must be subject to an annual review by an external expert who issues a report assessing the operational effectiveness of such measures and, where appropriate, proposes rectifications or improvements.

Exceptionally, article 31 of Royal Decree 304/2014 allows brokers and regulated entities included in article 2.1 i) to 2.1 u), both included, to be exempted from the obligations regarding internal control procedures, risk analysis, procedures manual, internal control bodies, training and external expert review, provided that they employ fewer than 10 people and their annual turnover or annual balance sheet total does not exceed 2 million euros.

Can EQA help me design and implement my money laundering prevention system?

No. EQA is a verification and certification body and does not provide advisory or consultancy services in its areas of activity. Our work consists of reviewing that the money laundering prevention system that has been implemented, that it operates in accordance with the provisions of Law 10/2010 and other applicable regulations, as well as the degree of implementation of the SEPBLAC Recommendations in order to issue a report on the adequacy of the policies and procedures to the legal requirements.

What obligations does the review of the anti-money laundering system by an external expert entail?

The result of the external expert review must be recorded in an annual report detailing all the control measures to prevent money laundering and containing an assessment of the operational effectiveness. This report must be submitted to the Board of Directors so that it can adopt the necessary measures to remedy the deficiencies identified within a maximum period of 3 months, and which, in any case, will be available to the Commission for the Prevention of Money Laundering and Monetary Offences for 5 years from the date of issue.

During the two years following the issuance of the report, Law 10/2010 allows the full annual report to be replaced by a follow-up report in which only the adequacy of the measures adopted by the obliged entity to remedy the deficiencies identified is assessed.

The reports must be issued no later than two months after the reference date that has been established. The reference date may be set by the obliged entity as long as it refers to a review period of one year or less.

Who can act as an external expert?

Law 10/2010 imposes the obligation to entrust the practice of external expert review to persons who meet the academic and professional experience conditions that make them suitable for the performance of the function and who have notified the Commission’s Executive Service of their status as external expert before starting their activity. EQA has had an external expert registered with SEPBLAC since 2016 with more than 13 years of experience in the implementation and review of money laundering prevention systems.

My organisation is a regulated entity but has not carried out any review of the money laundering prevention system. How can this situation be regularised?

As soon as the organisation starts any of the activities listed in article 2.1 of Law 10/2010, there is an obligation to carry out an annual review of the control procedures to prevent money laundering. When a regulated entity has not complied with the obligation to have an external expert review, it should hire one in order to avoid possible sanctions, stressing the importance of clearly defining the period subject to review and the reference date of the aforementioned review.

What are the consequences of not complying with the obligation to review the control procedures to prevent money laundering?

Failure to comply with the obligation of external review in accordance with the provisions of Article 28 of Law 10/2010 is considered a serious offence, the penalty for which includes a fine of at least 60,000 euros and up to a maximum of 5 million euros, public or private reprimands, and even temporary suspension of the activity when it is subject to administrative authorisation.

In addition, administrators and/or persons holding management positions may be subject to penalties of between 3,000 euros and up to a maximum of 5 million euros with public or private warnings, and even removal from office with disqualification from holding administrative or management positions for a maximum of 5 years in any entity subject to Law 10/2010.

Independently of the sanction for non-compliance with the external review obligation, additional sanctions may be imposed arising from non-compliance with other obligations linked to the money laundering prevention system that have not been detected or are unknown, and which would have been revealed when the review of the system was carried out by an external expert.

What is the difference between accredited certification and non-accredited certification?

The certification market is divided into two types of services: (i) accredited certification and (ii) non-accredited certification.

Basically, the difference is that the former is supervised by a body, in Spain, the Entidad Nacional de Acreditación – ENAC (Real Decreto 1715/2010, de 17 de diciembre) which, in the exercise of its public powers, grants, withdraws and supervises the performance of certification bodies. The non-accredited certification market, on the other hand, is not subject to any supervision.

It may be advisable to read this article published by ENAC on the differences between accredited and non-accredited certification for more information. Accredited certification is EQA’s approach to auditing and certifying compliance systems.

Contact us for more information on AML/CFT

Follow us

Tel. +34 913 078 648